We Provide All Loan Types

- Real Estate

- Acquisition

- Construction

- Permanent

- Hard Money

- Fix and Flip Lines

- Bridge Loans

- Development

- Acquisition

- Business Lines of Credit

- Used Auto Dealerships

- Lenders

- Financial Institutions

- Check Cashing

- Mariijuana

- Lines of Credit

- Unsecured Lines

- Secured Lines

- Working Capital

We offer secured and unsecured lines of credit that suit every company type, size and industry. If you are in need of funding for everyday business expenses such as employee wages, accounts payable, or utility bills, a line of credit is the answer to smooth over cash flow speed bumps. Our brokers and lenders will work with you to locate the financing option that is right for your business with low interest rates and a variety of repayment options.

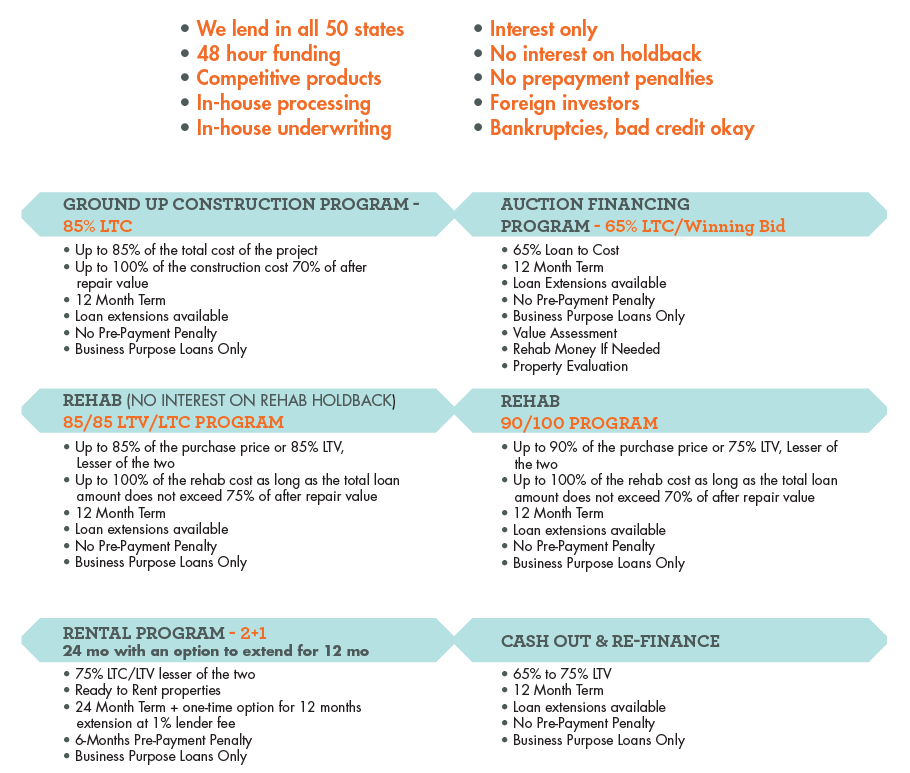

We offer both long and short-term real estate financing solutions, including acquisition, construction, development and permanent financing. Our solutions support business owners who are looking to purchase new property, develop land or fix and flip property for a profit. Our real estate financing options vary in length from 1 – 30 years with affordable rates. Loan amounts from $75K - $1MM up to 75% of ARV. Minimum 650 mid FICO score, no prepayment penalty, nationwide locations.

Loan amounts are from $2,500 - $250,000 with a 6 month term starting at 8%. Our 12 month term starts at 15%. To qualify for the $250,000 the business must be open for 3 years and a minimum of $2,000,000 in annual sales. Here's how it works-- Each time that you draw from the line you will pay it back in 6 or 12 equal monthly installments plus interest (depending on what termyou choose when you draw the funds. The line will increase as you use it and establish payment history. There are no fees to keep the line open.There are NO prepayment penalties and you'll only pay interest for the months that you use. Documents required - business loan app, last 3 mos bank statements, clear copy of DL (front & back). 48 hour approval.

We offer secured and unsecured lines of credit that suit every company type, size and industry. If you are in need of funding for everyday business expenses such as employee wages, accounts payable, or utility bills, a line of credit is the answer to smooth over cash flow speed bumps. Our brokers and lenders will work with you to locate the financing option that is right for your business with low interest rates and a variety of repayment options.

Types of Industries Served

Franchise Financing, Health Care & Medical, Non Profit & Churches, Real Estate Investors, Hotels, Resturants, Construction, Manufacturing